What's Wrong With This Picture?

Let me say this very clearly. I don't care that much about the Madoff financial scandal that is filling the headlines.

Let me say this very clearly. I don't care that much about the Madoff financial scandal that is filling the headlines.

I do care that many non-profits that invested with Madoff can't fund some great causes because the income from this Ponzi scheme is now gone. I do care that people that invested with him have lost their income streams. I do care that some of these people will be forced to put their homes on the market in what is nothing less than a crap economy.

However, what bothers me is how the SEC and others just didn't pick up on something being terribly wrong. Yes, there were investigations, but they didn't keep digging and analyzing when they couldn't figure it out. The SEC has admitted they dropped the ball on this one.

So some experts knew *something* was wrong but couldn't put their finger on it. Granted hindsight is 20/20 but this quote is from someone who advised his clients to not invest:

Jake Walthour, a principal at the hedge fund consulting firm Aksia LLC, said his firm was hired to investigate Madoff's business dealings by a potential investor several years ago.The problem is a lot of people did invest.

The probe raised several red flags, he said. Madoff's returns were "abnormally smooth" from month to month and had none of the volatility usually associated with stock investments. It seemed impossible to replicate his investment strategy or verify his track record.

Madoff claimed to be moving as much as $13 billion in and out of the market every month but "no one on the street could verify it or even see his footprints," Walthour said. "That organization was incredibly secretive."

He only issued simple paper reports to investors, not detailed electronic data streams that indicate how those investments are doing. There were few if any outsiders involved in his business. His auditor was a tiny accounting firm in Rockland County that no one had ever heard of before.

"We decided there are several scenarios here, one of which is, this could be a Ponzi scheme," Walthour said. "None of our clients invested."

Another interesting insight:

"There's no Duke Endowment [among the list of Madoff investors]," Hedges says. "There's no Harvard management, there's no Yale, there's no Penn, there's no Weyerhauser, no State of Texas or Virginia Retirement system."What's that saying that everyone is told not to ignore? "If it's too good to be true then it probably is." This was too good to be true, and people allowed themselves to be taken.

The reason is simple, in Hedges' view. Letting Madoff manage your money "wouldn't pass an institutional-quality due diligence process," he says. "Because when you get to page two of your 30-page due diligence questionnaire, you've already tripped eight alarms and said 'I'm out of here.' " In short, in Hedges' opinion, any sophisticated entity that actually did its homework would have seen the warning signs.

Madoff had a reputation as a Wall Street "insider". He was playing a big PR game. You couldn't just get into the fund; you had to be invited. So there was that cachet of both wealth and exclusivity.

What a great scam! He tapped into people's lowest common drives and pimped his reputation as an insider (he also "helped" the SEC with tips on investigating scams.) It appealed to the lowest of human drives. It invokes at least one, if not more of the Cardinal sins: greed and, for sure, some vanity too.

Consistently higher than normal returns that never react to the market? Yeah...whatever. You chumps.

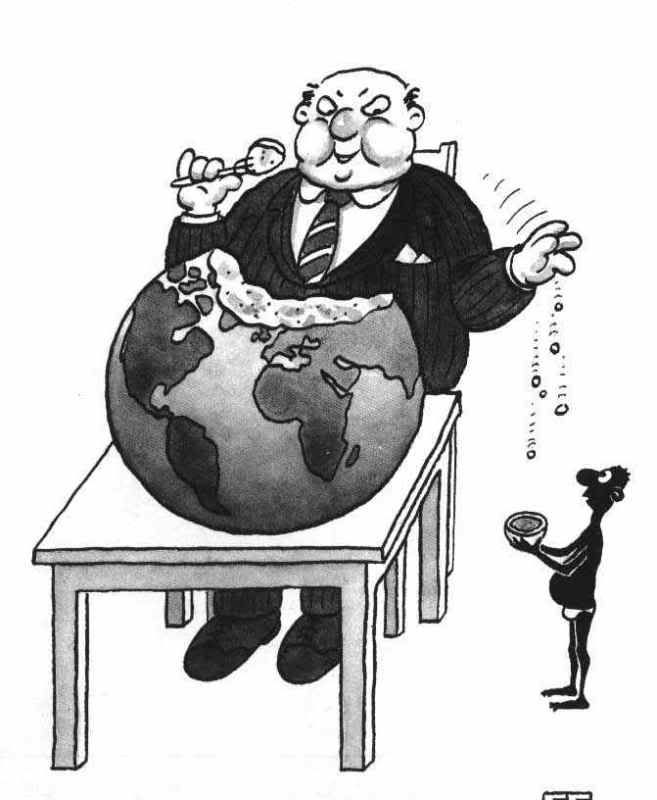

What bothers me is this. This whole trickle down economics bull crap. When things were going well, there wasn't much trickling anywhere. Except for the charities and non-profits, these people were taking this money for themselves. This money wasn't trickling anywhere except into their bank accounts. The only thing that was trickling down was credit too easily granted. The assets, the wealth, the real property all accrued to people who now might get less return on their investments, but, most likely, they're going to keep their homes, their wealth (in comparison to others) and their income stream. That is if they chose spread their investments to hedge against risk. If they invested exclusively with Madoff, they're in a world of financial hurt right now too. I've not lost my sympathy. However, the more I hear about this scam the more it seems that those who were caught by it simply chose not to get some basic answers.

But that's the problem...the hurt. This hurt is what has trickled down. Now that the fall out is negative it's trickle down economics on a massive and worldwide scale! People are loosing their jobs. They're loosing their homes. And, unfortunate et cetera after unfortunate et cetera.

Personally, for now, I'm okay but it's weighing heavy on my thoughts. Do I want to leave Korea now and enter a shrinking job market back home? On the flip side, do I want to stay here and be subject to the swings of the exchange rate? In the long-term I do think things will balance out. However, when I've got to make a firm decision in maybe another week or two, I'm going to have to go with my gut or just flip a coin.

I'm quite upset that the US Congress approved $700 billion to bail Wall Street. But the Senate chose to risk that the auto industry just might fail. Both have been bailed out before, but they make it seem like the auto industry is just the most horrible thing to try to save. Now the Bush can elect to use some of that money to help the auto industry, but the fact that the Congress didn't work overtime to agree to something is just ridiculous. The bankers are doing great. The workers, not so much. The fact that the news is barely commenting on the auto industry now and run this Madoff story every damn hour is also just infuriating.

I don't care that greedy people were invited into an exclusive club and then got ripped off.

Huffington Post: Time to Blame Our Own Greed For the Madoff Mess

Sphere: Related Content

These are truly interesting times that we are living!

ReplyDeleteAlicia

Wall Street Survivor

www.wallstreetsurvivor.com

A wee bit of an understatement. Chyrsler has just announced that they're shutting down their plants to conserve cash.

ReplyDelete